With Box secretly announcing it is going public, the storage games have begun.

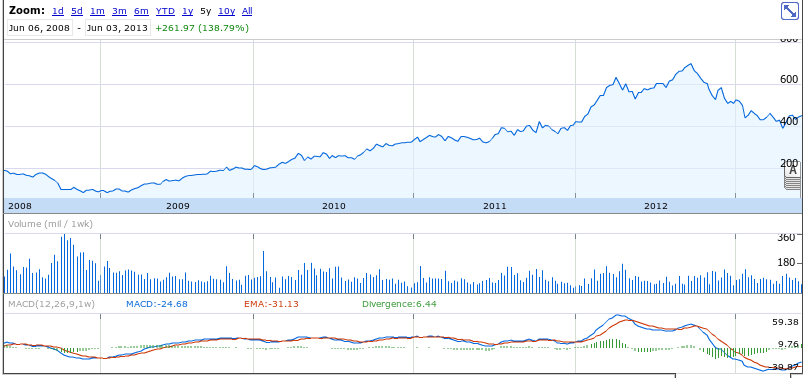

For quite some time I have been wondering where the tech plays of the next few years were coming. We had a product stage, we had a social media craze, we had a review site craze, a 3D printing craze and now we are going to have a storage craze. Technology will continue to advance and getting ahead of the curveball for the next “big thing” will only serve to pad your pockets.

Most tech savvy individuals use products like dropbox, box, cubby, etc. A larger majority of you have no idea the real benefits of those products in the business environment. Have you ever calculated the cost of building out the necessary networking infrastructure just to share files in the corporate environment? Do you know the cost benefits and ease of use capabilities of these online storage companies to small and medium sized businesses? Most importantly unlike the consumer purchase cycle for technology, the business purchase cycle is elongated.

This means that as the movement to the cloud has come into existence, many small and medium businesses are far from making their next storage purchase or moving towards the cloud. Take the small business I was at the other day, still using a decade old server to run multiple aspects of their business. Why pay to upgrade when you can wait? Most savvy business owners will put off capital expenses as long as possible. Add the fact that the cloud is still foreign to many business owners even in the 21st century and you have an area ripe for growth over the next five years.

When we talk cloud, storage and business companies like Google jump into the mix. What is great about Google is their ability to create great products and experience for their users. What is bad about Google (and Microsoft) is that no small or medium sized business is interested in placing all their tech needs in the hands of one technology giant. We all know gmail uses our emails to feed us ads. If they do that what else can they use against us? That may seem on the extreme side, but those thoughts enter customers minds every day.

So keep an eye on the online storage space, all fingers point to the space being hot in the next 24 months.